6 Gold Ira Companies: Review The Best Of 2022

Concluding Ideas on Gold IRAs Gold IRAs can be a clever investment, and you have options for picking a Gold IRA company - best gold etf to buy. Investing in a Gold IRA is among numerous ways to plan for retirement, and if you select to do so, you should be mindful of the method to do it wisely.

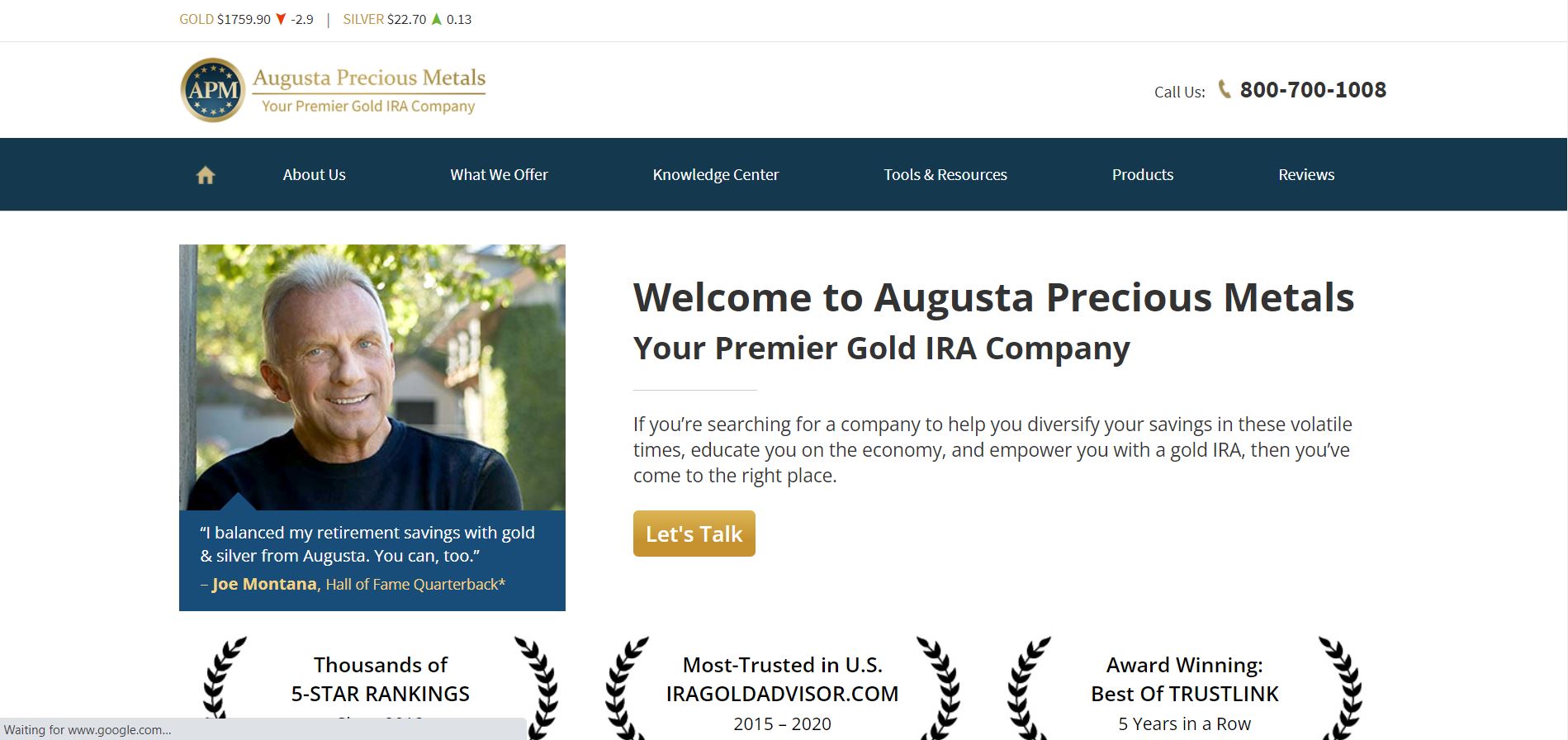

These companies earned our top spots among all classifications: The very best Gold IRA Companies - Augusta Precious Metals.

Precious Metals - Gold Ira - Silver Ira

Consider a gold IRA. Review the 7 best gold Individual retirement account business in this guide. Few financial investments have actually been around longer than gold.

In this guide, examine the very best gold individual retirement account business, the benefits and drawbacks of gold Individual retirement accounts, and typical charges to keep an eye out for. What is a Gold IRA? A gold IRA is a self-directed individual retirement account whose custodian has actually decided to use the capability to purchase gold. Due to regulations imposed by the IRS, numerous retirement accounts, such as Individual retirement accounts, are restricted in what properties they can consist of.

Precious Metals Ira Reviews

It's possible to invest in other properties as long as you can find a custodian who supports them. What's the distinction in between investing in a gold IRA and just buying gold directly? While gold may have some tax benefits, a gold individual retirement account permits you to buy gold on a tax-free or tax-deferred basis.

Gold is only enabled in IRAs that specifically determine it as a property you can purchase. In the majority of normal IRAs, gold is not allowed as an investable property, which is the difference in between a gold individual retirement account and other types. Which assets you can invest in are identified by your IRA's custodian.

The 7 Best Gold Ira Companies, Reviewed 2022

If you have an interest in gold as an investment asset, one of these business can help you get it at a tax-advantaged rate. 1. Goldco Valuable Metals: Best Overall Established in 2006, Goldco is a highly ranked gold individual retirement account company, with an A+ score from the Better Organization Bureau. Goldco will assist you open a rare-earth elements IRA whether you're investing for the very first time or rolling over an existing individual retirement account or a 401(k), 403(b), TSP, a savings account, or any other tax-advantaged retirement account.

They charge a flat annual cost for gold IRA account holders, which varies by customer. Considering that the rate corresponds, it comes out to a lower portion of your holdings the more possessions you have invested in your account. Gold kept in one of their self-directed Individual retirement accounts is safely kept in a depository they manage, and you can take payments either in the type of gold or money once you reach retirement age.

Gold Investment

With Augusta, you can invest in physical gold and silver at tax-advantaged rates. Augusta works with a number of trusted custodians, consisting of Equity Trust, Gold Star Trust Business, and Kingdom Trust.

You can quickly establish your gold individual retirement account with assistance from live agents, product preselection services to reduce confusion, and an easy purchasing process. They'll even help you with the documentation. Augusta stands apart for their transparent rates: they do not charge covert charges, disclose their bid/ask spread, and offer continual updates to continuous deals.

Birch Gold Group

Gold bullion, silver bullion, premium gold, premium silver Gold and Silver IRAInsured by Lloyd's of London, Roll over existing pension, Buy-back program Minimum investment: $5,000 Custodian account setup cost: $50Custodian upkeep charge: $80 annually, Depository storage cost: $100 annually, No commission fees, No management fees Finest transparent prices, No commission or management costs, Doesn't provide platinum or palladium 3. best gold companies to invest in.

Their group will guide you through the procedure of setting up a gold individual retirement account, and when it's open, they'll handle it immediately with little effort on your part. Patriot shops their gold in secure vaults across the U.S., but you can also store gold in the house in your own safe.

Etfs Physical Gold

Patriot Gold Group has a reputation for exceptional customer service, which assists them stand out from their competitors. They'll walk you through setting up your account either over the phone or online.

/images/2021/08/06/gold-stocks-to-invest-in.jpg)

They provide more instructional products than numerous of their competitors and their training program is developed to ensure you make a notified choice when opening your gold Individual retirement account. When you're prepared to set up your account, the process is likewise quite fast and easy.

A Guide On How To Find Best Gold Ira Companies

If you decide to open an individual retirement account, Noble Gold has a five-minute set-up procedure. Noble Gold uses free shipping and competitive rates on gold and other valuable metals. They pride themselves on a "no hard sell" policy and a "no-questions-asked" buy-back feature. Setting up an account is simple. Start by completing some basic forms online and they'll contact us to handle the more in-depth questions over the phone.

Any precious metals purchased through a Noble Gold IRA are kept in secure storage they supply. Qualified accounts consist of 401(k)s, 403(b)s, 457(b)s, TSPs, Roth, SEP or SIMPLE IRAs, and specific pensions. Gold, silver, platinum, palladium Gold, silver, platinum and palladium IRARoll over existing pension, Outstanding customer support Annual Charges: $80Storage Fee: $150 (if you save your possessions in Texas or Delaware)Custodian Charge: Varies by customer Outstanding buy-back service, No aggressive salesmen, Affordable fees, Annual costs high for low balances 5.

Best Gold Investment Companies 2022

/images/2021/08/06/gold-stocks-to-invest-in.jpg)

Is gold a good investment right now?

Keep in mind that while the price of gold in 2021 is not what it was in the two years prior, it's still a solid investment that's likely to provide stability for the long term. If your intent for the portfolio is to provide a comfortable flow of resources during your retirement years, gold is worth your consideration.

Can I buy gold at the bank?

No, there are only a limited number of banks that are authorized to sell gold. In addition, most banks don't sell physical gold but digital gold only. So, if you want to buy gold from a bank, you need to call them and confirm whether they sell gold or not.

Should I buy silver or gold now?

The best candidates for silver investments: Have a Total Portfolio Value of Under $35,000. Silver comes with a much lower price per once and is therefore more accessible than gold. Those just starting out with relatively small investment portfolios will likely be better served choosing silver over gold.

Where can I buy gold at market price?

How do I browse this siteGoldco invest in Read More Here gold best gold companies to invest in stocks?

In general, investors looking to invest in gold directly have three choices: they can purchase the physical asset, they can purchase shares of a mutual or exchange-traded fund (ETF) that replicates the price of gold, or they can trade futures and options in the commodities market.

Unlike many other gold Individual retirement accounts, they also offer a series of cryptocurrency investing options, which might interest investors searching for a combination of standard properties and novel ones. Regal Assets supports purchasing silver, platinum, and palladium as well. By offering a mix of hard properties and digital possessions, they believe they can provide security versus inflation and volatility, as well as earnings.

Regal Assets doesn't charge any extra charges for rollover or transfer services. best gold etf to buy.

5 Best Gold Ira Companies Of 2022 Precious Metals Ira

Benefit Gold: Best for Beginners One of the more recent arrivals on the gold individual retirement account scene, Advantage Gold was founded in 2014, however they have a solid track record and favorable consumer reviews. It's simple to set up an individual retirement account with Advantage; just use, your application will be evaluated by among their investment specialists, and you can money your account or rollover an existing retirement account.